Reaching financial freedom is one of the most liberating goals you can set for yourself. Imagine a life where your money works for you, not the other way around. While the journey to financial freedom can sound intimidating, it doesn’t have to be a slog. In fact, it can be incredibly fun if you adopt the right habits.

2025 is here, and it’s the perfect time to start taking control of your finances. Whether you’re just starting out, looking to refine your approach, or you’ve already dipped your toes into wealth-building waters, adopting these ten habits will help you achieve financial freedom in the new year.

Start Tracking Every Penny

Okay, so you might be thinking, “Who needs to track every penny?” Well, you do. The first step toward financial freedom is understanding where your money goes. Tracking your spending helps you identify your financial habits—good or bad—and gives you the power to make smarter decisions.

There are apps for that, such as Mint, YNAB (You Need A Budget), or even the old-fashioned pen-and-paper method. The goal isn’t to micromanage every little expense but to get a solid picture of your spending. Once you know where the money is leaking, you can patch up those holes and redirect funds into investments or savings.

Master the Art of Budgeting

Budgeting doesn’t have to be the dreaded word it’s often made out to be. Think of it as your financial roadmap—it helps you avoid detours, bad investments, and financial pitfalls. It’s all about knowing how much money you have and how you plan to use it.

Get creative with budgeting. You can create categories that suit your life—“Guilty Pleasures,” “Future Goals,” and “Emergency Fund” could all be in the mix. Use a digital tool like the 50/30/20 rule, where 50% goes to needs, 30% to wants, and 20% to savings and debt. Or use the envelope method if you're more into physical systems.

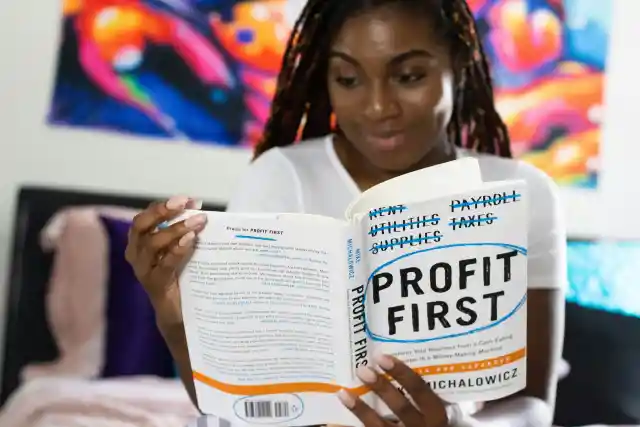

Invest in Yourself

While investing in stocks and real estate is often a big part of financial freedom, don’t forget about your most valuable asset: YOU. Invest in your knowledge, skills, and well-being.

Learning new skills and increasing your expertise can lead to better job opportunities, side hustles, or even a career change. Whether it’s taking an online course, learning how to negotiate for a higher salary, or mastering the art of time management, you’ll increase your earning potential and financial flexibility.

Embrace the Power of Compound Interest

The magic of compound interest is not just a financial concept; it’s a superpower. The sooner you start saving and investing, the more time your money has to grow.

If you’re not already investing, start. And if you are, make sure to focus on long-term investments. Compound interest means that the earlier you begin, the less you have to save to reach your goals. A small amount invested consistently will turn into a much larger amount over time.

Cut Back on Unnecessary Expenses

Let’s be real: we all have those "extra" expenses that drain our bank accounts. Whether it’s that overpriced subscription service you forgot to cancel or that impulse purchase you regret, small changes can make a huge difference.

Start by evaluating your monthly subscriptions—streaming services, fitness apps, and subscription boxes. Are they worth the money, or are you just paying for convenience? Could you switch to a cheaper alternative or, better yet, cancel them altogether?

Pay Down Debt

If you’re serious about achieving financial freedom, paying down high-interest debt should be a priority. Debt—especially credit card debt—can eat away at your wealth faster than you think.

Start with the highest-interest debts first (known as the avalanche method) or pay off the smallest ones first for that instant gratification (the snowball method). Either way, the goal is to reduce your monthly liabilities so you can divert those funds toward more productive endeavors, like investing or building an emergency fund.

Diversify Your Income Streams

The 9-to-5 grind isn’t the only way to earn money. In fact, relying on just one source of income can be risky, especially in times of economic uncertainty. Embrace the power of side hustles, passive income, or even turning hobbies into profitable ventures.

Start by brainstorming ways to leverage your skills or interests into additional income. Can you tutor? Freelance? Start an online business? Even renting out a spare room on Airbnb can be a lucrative option.

Stay Consistent and Be Patient

This is the habit that will make or break your journey to financial freedom: consistency. Wealth-building isn’t about making huge, dramatic moves once in a while. It’s about small, consistent actions over time.

Whether it’s saving a set amount every month, learning a little more about investing each week, or cutting back on expenses slowly but surely, consistency will lead to big results.

Build an Emergency Fund

Life is unpredictable. Unexpected expenses, like car repairs, medical bills, or sudden job loss, can throw you off track if you're not prepared. Building an emergency fund should be a priority. Aim for 3-6 months’ worth of living expenses, tucked away in a high-yield savings account that’s easily accessible but separate from your everyday spending account.

Having an emergency fund creates financial peace of mind. When life throws curveballs, you won’t have to dip into your investments or go into debt to cover those expenses. This financial cushion lets you focus on your long-term goals without getting derailed by short-term setbacks.

Stay On Top of Your Credit Score

Your credit score might seem like just a number, but it has the power to impact your financial future in a big way. A good credit score can lower your interest rates on loans and credit cards, saving you thousands over the years. Plus, it can open doors to opportunities like getting approved for mortgages or qualifying for better credit cards with perks.

Check your credit score regularly and work to improve it by paying bills on time, keeping your credit card balances low, and avoiding unnecessary credit inquiries. A little attention now can pay off big time when you need access to credit in the future.

Embrace Financial Automation

One of the most efficient ways to stay on track with your financial goals is to automate as much of your money management as possible. You don’t need to manually transfer money to savings, pay bills, or track every investment—let technology do the heavy lifting!

Set up automatic bill payments, transfer funds into savings or investment accounts, and even schedule regular contributions to retirement accounts. Automation will take the mental load off your plate, ensuring that your financial goals are consistently moving forward, even on the busiest of days.

Get Comfortable with Risk

Financial freedom doesn’t come from playing it safe all the time. While it’s important to be responsible with your money, it’s also crucial to embrace calculated risks. Whether it’s investing in stocks, real estate, or a side business, taking risks (when done wisely) can yield significant returns.

The key is understanding your risk tolerance. If you’re just starting out, start small and increase your exposure as you become more comfortable. Over time, you’ll learn how to balance risk and reward.